Which countries could be in Trump’s sights after Venezuela?

Us president donald trump’s 2nd term is being fashioned via his overseas coverage pursuits. He is accompanied by threats in opposition to venezuela with the aid of taking pictures of its president and his spouse from their closely fortified caracas compound in a dramatic overnight raid. When describing the operation, trump dusted off the 1823 monroe doctrine and its promise of us supremacy inside the western hemisphere – re-branding it the “donroe doctrine.” Right here are a number of the warnings he’s made in opposition to other international locations in washington’s orbit in recent days. Greenland The usa already has an army base on greenland – pituffik space base – but trump wants the whole island. “we want greenland from the viewpoint of national security,” he instructed newshounds, saying the place has become “included with russian and chinese ships everywhere in the location.” The good-sized arctic island, a part of the dominion of denmark, sits more or less 2,000 miles (3,200 km) to the northeast of the usa. It is wealthy in rare earth minerals, which are essential for the production of smart telephones, electric-powered vehicles, and navy hardware. Currently, china’s manufacturing of uncommon earths outweighs that of america. Greenland additionally occupies a key strategic place inside the north atlantic, giving it admission to the increasingly critical arctic circle. As polar ice melts in the coming years, new transport routes are expected to open up. Greenland’s top minister jens frederik nielsen spoke back to trump by means of describing the belief that folks have control over the island as a “myth.” “no more stress. No extra insinuations. No more fantasies of annexation. We are open to communicate. We’re open to discussions. However, this has to manifest through the proper channels and with admiration for worldwide law,” he said. Any attempt by us to seize greenland might deliver it into conflict with another nato member, probably putting the alliance in danger. Colombia Just hours after the operation in venezuela, trump warned colombian president gustavo petro to “watch his ass.” Venezuela’s neighbor to the west, colombia is home to giant oil reserves and is a first-rate manufacturer of gold, silver, emeralds, platinum, and coal. It is also a key hub for the area’s drug exchange—most drastically cocaine. For the reason that they started out striking boats in the caribbean and eastern pacific in september – saying, without proof, they were sporting drugs – trump has been locked in a spiraling dispute with the USA’s left-wing president. The usa imposed sanctions on petro in october, announcing he was permitting cartels to “flourish.” Speaking aboard air pressure one on sunday, trump said colombia become “run by means of an unwell man who likes making cocaine and promoting it to the united states”. “he is not going to be doing it for extremely long,” he said. Asked whether or not the us might carry out an operation concentrated on colombia, trump answered, “it sounds accurate to me.” Traditionally, colombia has been a close best friend in washington’s war on tablets, receiving hundreds of millions of greenbacks annually in navy help to counter cartels. Iran Iran is presently dealing with mass anti-government protests, and trump warned in a single day that the authorities there might be “hit very hard” if extra protesters died. “we are watching it very intently. In the event that they start killing human beings like they have inside the beyond, i assume they are going to get hit very tough by way of us,” he told newshounds on air pressure one. Iran theoretically falls outside the scope described in the “donor doctrine”; however, trump has formally threatened the iranian regime with further action after putting its nuclear centers on notice for the last 12 months. The ones that struck came after israel launched a huge-scale operation geared toward decapitating iran’s capability to increase a nuclear weapon, which culminated in the 12-day israel-iran war. In a mar-a-lago assembly between trump and israeli top minister benjamin netanyahu remaining week, iran become stated to be top of the agenda. Us media said that netanyahu raised the capacity of recent strikes towards iran in 2026 Mexico Trump’s rise to strength in 2016 turned into being described by using his calls to “build the wall” along the southern border with mexico. On his first day back in office in 2025, he signed a government order to rename the gulf of mexico the “gulf of the usa”. He has often claimed mexican government is not doing enough to prevent the flow of medicine or unlawful immigrants into the usa. Speaking on sunday, he said that tablets were “pouring” via mexico and “we’re going to have to do something,” adding that the cartels there have been “very robust.” Trump stated he is prepared to send us troops to mexico to combat cartels; however, president claudia sheinbaum has publicly rejected any us navy action on mexican soil. Cuba The island state, just 90 miles (145 km) south of florida, has been under us sanctions since the early Sixties. It held near members of the family with nicolás maduro’s venezuela, which reportedly provided roughly 30% of cuba’s oil in trade for doctors and medics journeying inside the other route. With maduro gone, havana can be uncovered if the oil supply collapses. Trump recommended on sunday that us navy intervention wasn’t needed, due to the fact cuba is “prepared to fall.” “i don’t think we need any motion,” he said. “it looks like it is going down.” “i don’t know if they’re going to maintain it, but cuba now has no earnings,” he added. “they were given all their profits from venezuela, from venezuelan oil.” Us secretary of country marco rubio – who’s the son of cuban immigrants – has long referred to the regime alternate in cuba, telling newshounds on saturday: “if i lived in havana, and i used to be inside the authorities, i would be concerned—as a minimum, a little bit.” “while the president speaks, you ought

Australian state plans to ban intifada chants after Bondi shooting

The Australian state in which the Bondi taking pictures came about plans to ban the phrase “globalize the intifada” as a part of a crackdown on “hateful” slogans. New South Wales (NSW), most useful Chris Minns, has additionally called for a royal commission into the Bondi attack, marking the deadliest shooting in Australia in nearly 30 years. Fifteen people were killed and dozens injured last Sunday while two gunmen, believed to have been encouraged by using “Islamic State ideology,” opened fire on a Jewish competition at the United States’s most iconic beach. Australia’s kingdom and federal governments have announced a raft of measures to counter extremism because of the assault. Minns plans to not forget the country parliament next week to bypass via stricter hate speech and gun regulations. In advance this week, he also suggested he could tighten protest laws to scale back mass demonstrations to inspire “a summertime of calm.” The most excellent confirmed he would be looking to classify the chant “globalize the intifada” as hate speech. Pro-Palestinian protesters were arrested on Wednesday for allegedly shouting slogans involving intifada at an indication in significant London. The time period “Intifada” got here into famous use at some stage in the Palestinian rebellion in opposition to the Israeli occupation of the West Bank and Gaza Strip in 1987. A few have defined the time period as a name for violence in opposition to Jewish human beings. Others have stated it’s a call for peaceful resistance to Israel’s occupation of the West Bank and actions in Gaza. In advance this week, Minns, at the side of the NSW opposition chief Kellie Sloane, attended the funeral of Matilda, 10, who turned into the youngest victim of the Bondi capturing. He read out a poem committed to the younger woman on the occasion. Top minister Anthony Albanese has announced a new gun buyback scheme to purchase surplus, newly banned, and unlawful firearms. Hundreds of lots of guns will be amassed and destroyed, the authorities predict. Around 1,000 lifeguards staged a tribute on Saturday, lining up arm-to-arm facing the ocean at the beaches of Bondi Beach. Surf lifesaving teams at different seashores around Australia were photographed appearing at a comparable memorial. Throughout the week, Bondi’s surf volunteers were venerated as a number of the heroes of the capturing. Lifeguard Jackson Doolan was photographed sprinting over from a neighboring seaside at some point of the assault wearing a purple clinical supply bag. Hundreds of swimmers and surfers paddled out at Bondi Seaside yesterday to create a massive circle to pay tribute to the sufferers of the assault. On Sunday, Australia will observe a countrywide day of mirrored image with the theme “light over darkness,” marking precisely one week after the attack began with a minute’s silence at 6:47 pm (0747 GMT). Flags will fly at half-mast, and Australians are being requested to light a candle in their windows to honor the sufferers. “Sixty seconds carved out from the noise of everyday existence, devoted to fifteen Australians who have to be with us nowadays,” Prime Minister Albanese informed newshounds Saturday. “It’ll be a moment of pause to mirror and verify that hatred and violence will in no way define us as Australians.” Bondi’s attack became Australia’s worst mass capturing on the grounds of Port Arthur in 1996, wherein 35 humans were killed and precipitated then-Prime Minister John Howard to introduce strict gun management measures.

U.S. retail prices rise slightly in November, core inflation remains steady

Purchaser fees within the usa rose by 0.3 percent in november as compared with october, information from the labor branch confirmed on thursday, as meals and housing costs increased. With the exception of risky meals and electricity sectors, core inflation rose by 0.2 percent, a sign that inflation pressures stay slight but continual. Economists assume the modest rise won’t regulate the stance of the federal reserve when it meets the subsequent week to check hobby-fee coverage. Markets had largely priced in no immediate alternate, given the latest symptoms of cooling demand and a slow wage boom. Retail sectors experienced mixed results: while food, groceries, and utilities published better charges, spending-sensitive categories like electronics and apparel saw flat or slightly decreased fees, in all likelihood reflecting careful consumer sentiment ahead of the vacation season. Analysts say the inflation fashion remains viable for now but warn that sustained increases in housing and food costs could erode purchaser buying electricity through the years. Why these topics: Even a small inflation uptick impacts household budgets, specifically in simple necessities. Core inflation is regular; this continues stress at the important bank’s rate selections unchanged. For investors and groups, solid inflation helps modest increase expectancies for retail and carrier sectors. If you want i can generate 2–3 equipped-to-put-up articles right now (on the usa economic system, worldwide information, or any topic you pick out) that also consist of prepared html + meta tags + schema markup for each, so you simply reproduction-paste them.

US stocks dip as Treasury yields rise ahead of Fed meeting

U.S. Stock markets ended modestly lower on monday, weighed down by a surge in treasury yields and clean data suggesting manufacturing pastime remained slow. Reuters Buyers at the moment are targeted on the approaching policy meeting of the federal reserve, with many watching for recommendations of future fee decisions, a pass that has heightened volatility across equities and bond markets. Momentum‑sensitive sectors, especially increasing and tech shares, suffered the most as traders adjusted their expectations. Some analysts warn that if yields rise excessively, borrowing expenses could be thrust upward, affecting company earnings and client sentiment alike. Why this matters The outcome of the fed’s upcoming choice should reshape international markets and investment flows. A risky response in u.S. Markets often influences global indices which includes rising markets. For your readers in the usa or the ones following the worldwide economic system: this sets the tone for close-to-time-period monetary developments and may affect import/export prices, consumer loans, and investments.

US Consumer Confidence Drops Amid Government Shutdown

U.S. Patron sentiment has slumped sharply to certainly one of its weakest readings in over three years, in step with a University of michigan survey, as the extended federal government shutdown drags on. The sentiment index fell to 50.3 in early november, down from 53.6 in october, highlighting large financial tension throughout specific income agencies and political affiliations Economists say the drop displays a a deep challenge over process protection, the disruption of federal offerings, and uncertainty about when the shutdown would possibly give up. The survey also noted an upward push in inflation expectations among households. A few analysts warn that those bad sentiment traits could further drag patron spending, threatening gdp increase within the near time period, specifically if the political impasse keeps up.

Trump tells McDonald’s franchisees inflation fight is a daily battle

Former President Donald Trump met with McDonald’s proprietors, operators, and suppliers in Washington, wherein he touted his administration’s efforts to address inflation through tax cuts and reshoring of manufacturing. Trump recounted that even though development has been made, “there’s still a number of things to do” to ease the fee burden on Americans. He defended his tariff rules, declaring that he recently removed responsibilities on over 200 food imports, a flow he frames as part of a broader fight to lower dwelling costs. At the collection, Trump additionally floated unconventional proposals, like a $2,000 tariff-funded take-a-look-at for citizens and 50-year mortgage guidelines he argues could help everyday people navigate inflationary pressures. Economic watchers remain divided. While a few support his method for enhancing manufacturing and cutting tax burdens, others warn that tariff-funded giveaways could get worse, change tensions, and distort markets.

US Retail Sales Rise in October But Consumers Stay Cautious

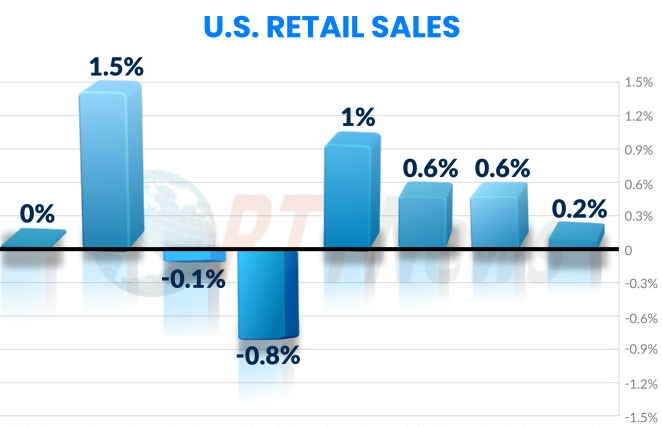

Current information from the nationwide Retail Federation (NRF) suggests that U.S. retail income climbed by 0.6% in October, excluding car dealerships and gasoline stations. (NRF) Notwithstanding this monthly benefit, analysts warn that customers remain cautious. Circana, a market studies firm, reported that at the same time as spending on food and essentials rose, discretionary spending—especially on big-ticket gadgets—cooled. (Circana) The NRF’s October facts also confirmed a 5% year-over-year increase in overall retail sales (except automobiles and fuel), signalling moderate momentum as the holiday season starts. However, as NRF CEO Matthew Shay noted, “the latest economic statistics have been blended,” with inflation issues and chronic uncertainty nonetheless pressuring consumers. In the meantime, Circana pointed out that consumers are being “nimble” with their spending, prioritizing requirements and balancing wallets below inflationary headwinds. Inside the 4 weeks ending November 1, they found that whilst greenback income grew by 2%, the variety of items bought in keeping with the household stayed flat compared to the final year. Why This Matters: A 0.6% month-to-month bounce indicates that customer spending isn’t always definitely weakening precise news for stores as the holiday season tactics. However, cautious shopping behavior indicates Americans are looking at where they spend, which could restrict upside increases. For buyers and policymakers, the facts underscore an intricate balancing act: assisting growth without igniting inflation.

US government shutdown setback casts shadow over Q4 growth

The 39-day federal government shutdown in the United States is showing signs of potential resolution, but its lingering effects are already weighing on economic growth and investor sentiment. The Senate cleared a procedural vote Sunday to move ahead with legislation aimed at reopening the government, offering a glimmer of relief for markets and federal workers alike. Reuters +1 Despite this progress, economists warn that the damage may already be done: output in the fourth quarter is at risk of slipping into negative territory if the shutdown continues. ReutersMajor sectors such as air travel are facing delays due to staff shortages among air traffic controllers, a key example of the shutdown’s wide-ranging ripple effects. Reuters Market responses were swift. Stock futures rose; S&P 500 futures climbed 0.8%, and Nasdaq-100 futures jumped 1.3% as the possibility of an end to the shutdown eased some of the uncertainty that has weighed heavily on investor sentiment. Reuters analysts caution, however, that the data backlog produced by the shutdown will take time to clear and could leave growth forecasts muted for months. Why this matters: A government shutdown doesn’t just halt services; it delays data releases, disrupts operations, and chips away at confidence in the economy. The possible slide into negative growth for Q4 raises risks for global markets, especially given the U.S. economy’s outsized role. For your readers interested in economics and markets, this story connects policy gridlock with everyday impacts: from job security to borrowing costs. Key takeaway:Even as lawmakers move toward reopening the government, the disruption has already cast a large shadow over the U.S. economy. Whether growth rebounds in the coming quarters will depend on how quickly normal operations resume and how deeply the freeze affected private and public sectors alike.

US job market shifts: “No hire, more fire” trend emerging

New data show that the US labor market is undergoing a noticeable shift. Employers announced nearly 950,000 job cuts between January and September 2025, highlighting a departure from the earlier “no hire, no fire” scenario to what analysts are calling a “no hire, more fire” environment. Reuters+1 Major names across tech, retail, and government sectors are part of this trend. For example, companies such as Amazon, UPS, and Intel have announced large-scale job reductions, citing automation, cost-cutting, and the end of pandemic-era hiring booms. Reuters The slowdown is especially significant because it comes at a time when government data releases like the official employment report have been delayed due to the ongoing federal shutdown. Private-sector job trackers suggest that hiring is weak and layoffs are rising. Reuters+1 Why it matters: A weakening labor market can affect consumer spending, which is a major driver of the US economy. With hiring down and layoffs up, workers may become more cautious, affecting industries that depend on discretionary spending. For your readers, this signals a moment of change in the US economy: not outright collapse, but caution and recalibration. Key Takeaway:The US job market has now entered a phase where companies are not aggressively hiring and are increasingly trimming jobs. If this continues, it may reshape economic growth patterns in the near term.

Mass layoffs reach nearly 1 million in U.S. job market shake-up

U.S. companies announced about 950,000 layoffs in the first nine months of 2025, marking a sharp uptick in job cuts as businesses turn more cautious amid weaker demand, rising automation, and cost pressures. (Reuters) Major global firms such as Amazon, UPS, Microsoft, and Intel led the trend, citing strategic restructuring, increased use of AI, and a need to reverse pandemic-era hiring. The job cuts span sectors including tech, retail, and government. Analysts interpret this shift as an indicator that the U.S. labor market is entering a new phase: hiring has stalled and layoffs are rising, a pattern described as “no hire, more fire.” This change has drawn attention from the Federal Reserve, which may consider further interest-rate cuts to cushion economic risks. Though the unemployment rate remains relatively stable, the underlying dynamic of labor-market weakening is raising concerns. If job cuts continue or accelerate, the broader economy could face slower growth and tighter credit conditions for workers.